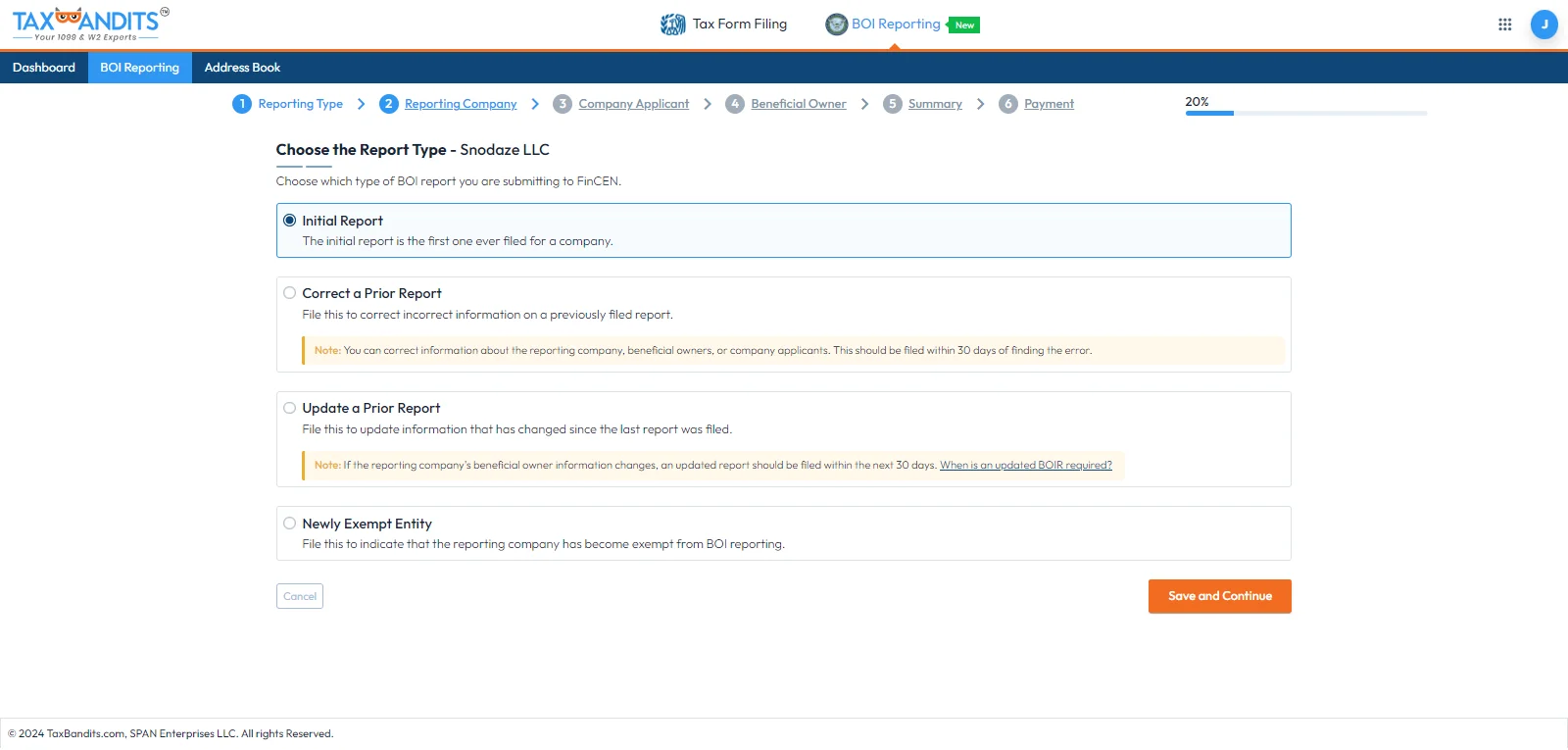

Boi Reporting 2025 Texas Reporting. Fincen now requires all owners of entities with foreign ownership to file a beneficial ownership information report. Provides interactive checklists, infographics, and other tools to assist businesses in complying with the boi reporting rule.

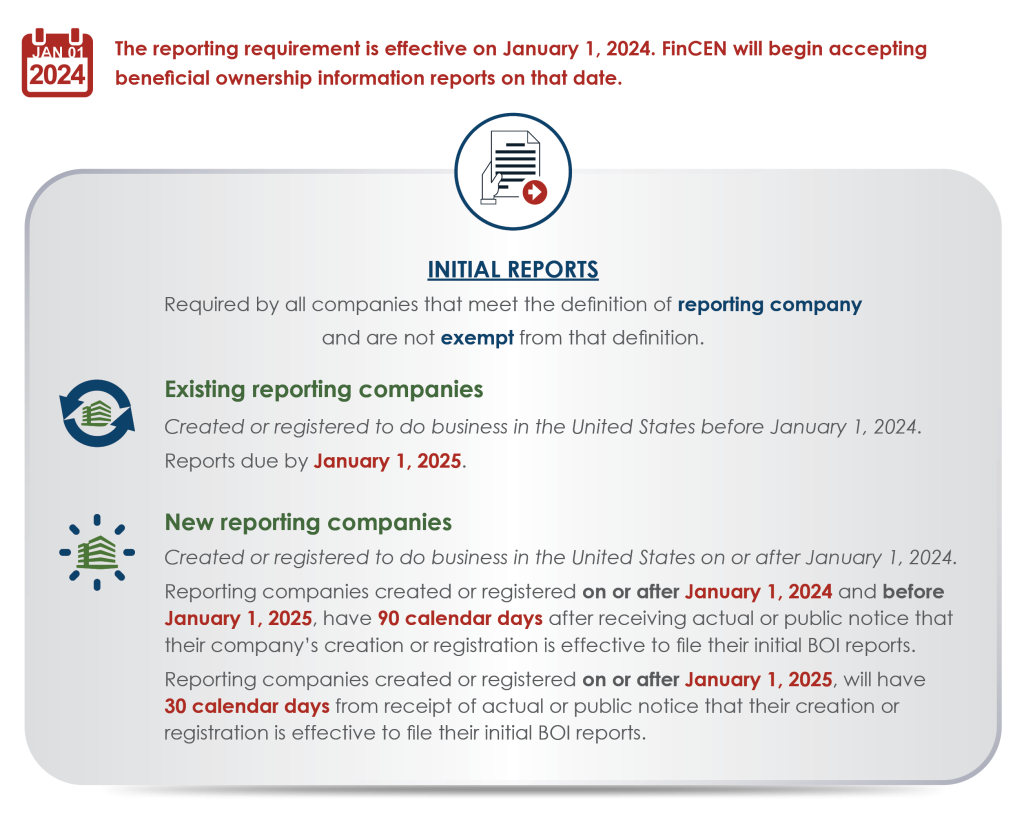

The following materials are now available on fincen’s beneficial ownership information reporting webpage, www.fincen.gov/boi: The requirements become effective on january 1,.

Understanding the 2025 BOI Reporting Requirements — AJB Law, The requirements become effective on january 1,.

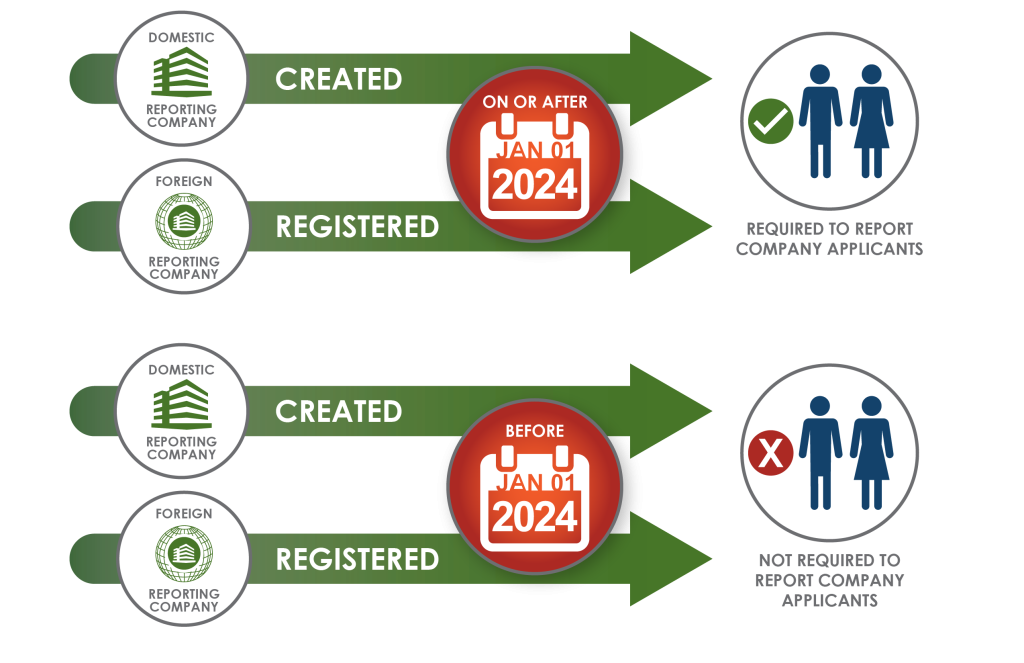

The Corporate Transparency Act Navigating BOI Reporting in 2025 By, It took effect on january 1, 2025, and imposes a new federal filing requirement for most corporations, limited liability companies (llcs), and other business entities.

New Business Owner Reporting 2025 BOI Reporting Requirements YouTube, Fincen now requires all owners of entities with foreign ownership to file a beneficial ownership information report.

BOI Reporting New for 2025 The Boom Post, Effective january 1, 2025, most corporations and llcs in.

Demystifying new BOI Reporting for 2025 A NoSweat Guide for Business, Similarly, if a reporting company changes its jurisdiction of formation (for example, by ceasing to be a california corporation and becoming instead a texas corporation), it must.

BOI LLC 2025 . Any Reporting Company Created Or Registered On Or After, Businesses created before 2025 have until december 31, 2025, to comply.

The Corporate Transparency Act Navigating BOI Reporting in 2025 By, Answers to frequently asked questions.

All You Need To Know About Beneficial Ownership Information Reporting, Reporting companies formed or registered after january 1, 2025, must file initial beneficial ownership information, or boi, reports within 90 days after their formation or.

BOI Reporting Terms When You Need to File Beneficial Ownership, Businesses created before 2025 have until december 31, 2025, to comply.